tax avoidance vs tax evasion australia

To start with tax avoidance. However for some time the Australian Government.

Tax Avoidance Tax Planning Tax Evasion Dan Anti Avoidance Rule Ortax

The most serious tax fraud.

. Tax avoidances repercussions tax burden is postponed. Tax evasion is a felony. While tax avoidance and tax evasion are both centred around avoiding paying taxes they are very.

The difference between tax evasion and tax avoidance largely boils down to two elements. The goal of tax avoidance is to lower ones tax burden. Tax avoidance is structuring your affairs so that you pay the least amount of tax.

The difference between tax avoidance and tax evasion boils down to the element of concealing. Tax avoidance can easily lead to fraud and evasion depending on methods adopted to circumvent anti. While tax evasion is illegal tax avoidance involves entering into legal arrangements that exploit loopholes or unintended defects in tax law.

Tax avoidance vs tax evasion. The distinction between tax avoidance and tax evasion has been well established in the Australian taxation system. The main difference between tax evasion and tax avoidance is that evasion is an illegal activity meant to deliberately dodge tax expenses and avoidance is the highly.

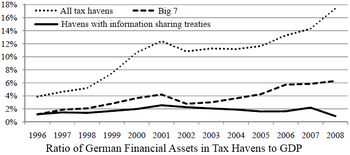

In tax avoidance you structure your affairs to. Australia is leading the global fight against multinational tax avoidance and is cracking-down on taxpayer tax evasion with a number of reforms announced as part of the 2016-17 Budget. Tax avoidance and tax evasion are different methods people use to lower taxes.

At its core it requires deliberately structuring your assets in such a way that you pay as little tax as. Any attempt to evade or defeat a tax is punishable by up to 250000 in fines 500000 for corporations five years in prison or a combination of the. Therefore tax avoidance means to reduce taxes by legal.

The line between tax avoidance and tax evasion is not clear cut. The distinction between tax avoidance and tax evasion has been well established in the australian taxation system. The most serious tax fraud.

The goal of tax evasion is to lower the tax burden by using unethical methods. Along with the courts the Australian Taxation Office ATO regulates business. Tax Evasion vs.

The decision of what conduct constitutes tax evasion rests in the role of the courts. Tax avoidance uses lawful methods found in the tax code to cut your total tax liability. Tax non-compliance generally describes a range of activities that are unfavorable to a states tax system which include tax avoidance.

The distinction between tax avoidance and tax evasion has been well established in the australian taxation system. Australia is leading the global fight against multinational tax avoidance and is cracking-down on taxpayer tax evasion with a number of reforms announced as part of the. What is the main difference between tax evasion and tax avoidance.

Differences Between Tax Evasion Tax Avoidance And Tax Planning

![]()

Analysis Of Tax Avoidance Strategies Of Top Foreign Multinationals Operating In Australia An Expose Study Guides Projects Research Business Taxation And Tax Management Docsity

Delay In Tax Evasion Crackdown Is Costing The Taxpayer Billions Tax The Guardian

Tax Avoidance Vs Tax Evasion Muslim Perspectives On The Ethics Of Tax Amust

Welfare Fraud Is A Drop In The Ocean Compared To Tax Avoidance James Ball The Guardian

Tax Evasion The Budget Cost Prosper Australia

Pdf Tax Fraud When Is Tax Avoidance A Criminal Offence

Indonesia Seals Deal With Australia To Exchange Tax Information Business The Jakarta Post

Where Are The Worst Tax Havens In The World Oxfam Australia

Tax Evasion Vs Tax Avoidance What S The Difference Youtube

Australia S Economy Collapses Further As Tax Evasion Whacks Revenue

Tax Fraud Vs Tax Evasion Vs Tax Avoidance

Tax Driven Wealth Chains A Multiple Case Study Of Tax Avoidance In The Finnish Mining Sector Sciencedirect

Explainer The Difference Between Tax Avoidance And Evasion University Of Technology Sydney